As artificial intelligence evolves, so do the methods used by fraudsters. A growing concern in the digital world is the use of AI-generated photos to commit insurance fraud and KYC scams. These realistic but fake images are helping criminals bypass verification systems and file fraudulent claims – costing businesses and consumers billions.

How Are AI Images Used in Insurance Fraud?

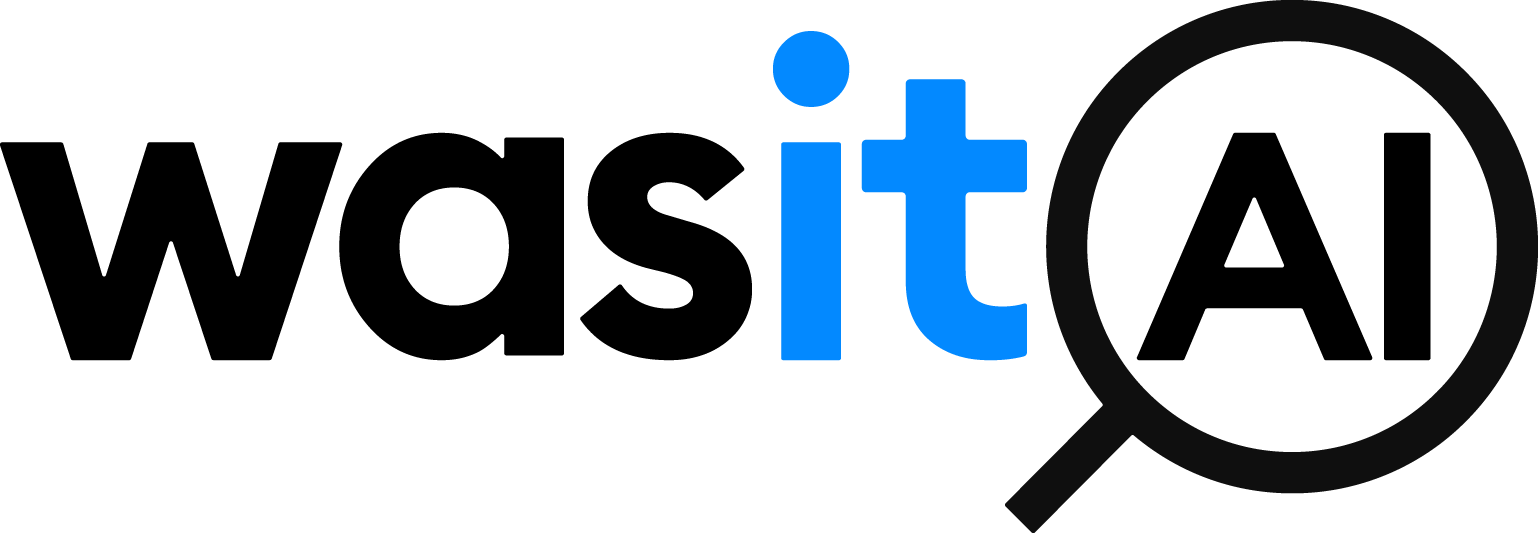

Insurance fraud is increasingly being fueled by AI-generated content. For instance, scammers are now using fake photos of car accidents, generated by AI tools, to support false auto insurance claims. In one example reported by MoneySuperMarket, fraudsters submitted images of damaged vehicles that were completely fabricated using generative AI. These visuals are often so convincing that they pass preliminary checks.

Renegade Insurance and Swiss Re both highlight how AI can amplify fraud across all lines of insurance – health, home, travel, and more – making manual detection nearly impossible.

What About KYC Scams?

KYC (Know Your Customer) processes are crucial in banking, fintech, and crypto platforms to verify the identity of users. Unfortunately, AI-generated passport photos and face images are now being used to bypass KYC checks. A real-world case shared on LinkedIn showed how an AI-generated passport passed a live KYC screening process – highlighting a serious flaw in digital onboarding.

Kaspersky explains that these synthetic images can fool facial recognition systems, allowing criminals to create fake identities and open fraudulent accounts – often for money laundering or phishing attacks.

Why This Matters

The misuse of AI for insurance fraud and KYC scams presents a growing threat to trust and security in digital services. While AI brings many benefits, its abuse in creating realistic fake images shows how quickly fraud tactics are evolving.

How Can We Fight Back?

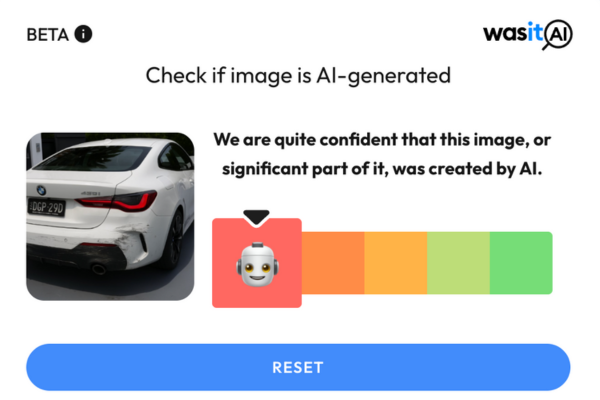

Stronger detection tools, like AI-image verification services, are needed to spot synthetic content before damage is done. Human oversight, combined with smarter algorithms, is essential in closing the gaps.

One such solution is WasItAI – a service that detects whether an image has been generated or manipulated by AI. Tools like this are critical for insurers, banks, and fintech platforms looking to protect themselves from rising insurance fraud and KYC scams.

As the fraud landscape evolves, staying informed – and equipped – is the first step to staying protected.